This content is password protected. To view it please enter your password below: Password:

3 simple money management tips for couples who want to be happier

#1 Understand your spouse’s money personality Money is one of the most challenging topics to discuss. I have used Money Habitudes and found it to be a quick and effective way couples can relate to one another. The non-threatening game...

Financial Educators & Counselors Financial Planners Money Habits & Attitudes Blog Relationship Counselors Therapists, Coaches & Social Workers

Managing Financial Stress During a Health Event

Money is one of the hardest topics for people to talk about in a relationship. During a health crisis, practicing good money habits isn't at the front of anyone’s mind. But, in times of uncertainty, it’s one of the...

Numbers May Not Be The Answer

What to ask clients who want to change their financial behaviors

Relationship Holiday Spending Tips

According to a Nerd Wallet 2022 survey, nearly one-third of people reported that they still owe money from last year’s holidays, and 72% plan to charge this year’s holiday purchases on credit cards. Many opt for store buy-now-pay-later deals, cash advances,...

How to Teach Your Kids About Financial Security

Cara Macksoud Children are often left in the dark about what goes on with the family's finances. Early lessons set the stage for financial confidence in adulthood. Parents teaching responsibility prepares kids to manage their money independently. Though not all...

FAQs to get started with Money Habitudes Online

FAQs to get started with Money Habitudes Online

Financial Educators & Counselors High School Educators & Youth Leaders Money Habits & Attitudes Blog Therapists, Coaches & Social Workers

Money Habitudes: How To Be Rich in Life & Love Wins Excellence in Financial Literacy Education Award

Engaging and innovative financial education curriculum with a focus on the psychology of money and behavioral economics helps teens with personal finances and relationships.

Signs of Financial Infidelity: Is Your Partner Cheating on You?

Melanie Lockert Feb 06, 2019 6 second take: Sexual and emotional dishonesty aren’t the only things that can destroy a relationship. Financial infidelity can, too. Infidelity of any kind can tarnish even the strongest relationship. It feels like the ultimate...

Corporate Wellness & HR Professionals Financial Educators & Counselors Money Habits & Attitudes Blog

2018 UK Workplace Stress Survey

The 2018 UK Workplace Stress Survey Executive Summary Work is the most common cause of stress for UK adults, with 59% experiencing it. Just 9% say they ‘never’ experience work-related stress, while only 12% consider the levels of work-related stress...

Financial Educators & Counselors High School Educators & Youth Leaders Therapists, Coaches & Social Workers

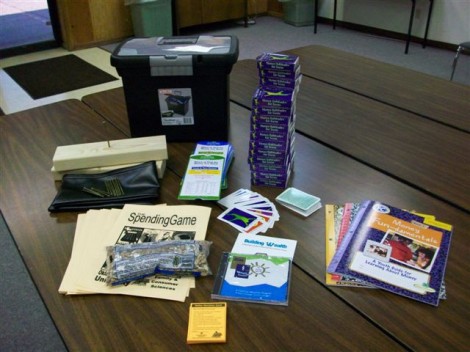

Teen Financial Curriculum

This fun and easy curriculum helps teens identify financial patterns and how those affect their relationships and goals. Winner of an Excellence In Financial Literacy Education Award.

Talking About Money in a Youth Employment Program

A national nonprofit based in San Francisco, MyPath reaches 4,000 youth each year, ages 14-24, in California, Nevada, Washington, and Missouri through more than 50 partner sites. The organization focuses on building economic pathways by integrating banking and saving into...

Financial Educators & Counselors Money Habits & Attitudes Blog Relationship Counselors Therapists, Coaches & Social Workers

Overcoming the social stigma of getting financial help

Social stigma plays a big role in whether people seek out financial coaching, counseling, or education. Social stigma also plays a part in whether people feel good while getting financial help. People often use Money Habitudes to reduce the perceived...

Financial Opportunity Centers: dialogue with financial coaches, clients & funders

The Issue: How to create a productive connection between financial coaches and coaching clients at Financial Opportunity Centers. And how to demonstrate the intricacies of a financial coaching program to funders. Who: Valerie Moffitt is a Program Manager with Local...

financial coaching v. financial counseling v. financial planning v. financial education

What is financial coaching? Is it the same as financial counseling or financial planning? Are those different from financial education? It's a pretty basic question of financial terminology, but an important one. After all, people often interchangeably use these terms...

An innovative peer teaching financial education program for kids

The Issue: How to develop a scalable peer teaching financial literacy program that's fun and easy enough for kids to teach other kids. Who: Amanda Christensen is an Extension Assistant Professor at Utah State University and a 4-H and youth...

Financial Educators & Counselors Financial Planners Money Habits & Attitudes Blog Therapists, Coaches & Social Workers

Emotional triggers and financial stress

Financial stress is serious. It was identified as the number one cause of stress in a 2009 study by the American Psychological Association. Increases in financial stress are associated with: suicide attempts and suicide rates physical illness divorce rates domestic...

Making financial classes for women more engaging

The Issue: How to make financial classes for women more engaging and welcoming while providing valuable skills for handling money. Who: Emily Adams is an agriculture and natural resources educator with Ohio State University Extension Service in Coshocton County. What:...

Financial Educators & Counselors High School Educators & Youth Leaders Money Habits & Attitudes Blog

5 Tips for More Fun and Effective Financial Classes

Do you feel like you have so much information to share that you need to make the most of every moment when you teach financial education classes? Research has shown us that how we teach may be more important than...

Financial Educators & Counselors High School Educators & Youth Leaders Money Habits & Attitudes Blog

A new credit curriculum to teach a credit class

Building on the popularity of Money Habitudes, we've just released The Good Credit Game. It's a credit curriculum kit that makes it fun and easy to teach credit classes. The Good Credit Game covers credit reports, credit scores and credit...

Financial Educators & Counselors High School Educators & Youth Leaders Money Habits & Attitudes Blog

Financial literacy for college student financial aid

Colleges and universities use Money Habitudes to promote financial literacy for college students. It may be a student financial aid office running a financial aid workshop or using the tool in financial counseling sessions. It's also used in several colleges'...

An adult continuing education financial program for auctioneers

The Issue: How to add interesting, engaging content to a continuing education financial program. Who: Zona Hutson is an Extension Agent with WVU. She works in Doddridge County, West Virginia. What: WVU Extension Service teaches a recertification class for the...

Financial education program for bogus check writers

The Issue: How to help people understand their financial attitudes and spending habits in a fun way in a financial education program. Who: Susan Routh is an Extension Educator in Family and Consumer Sciences in Grady County, Oklahoma. She also...

Corporate Wellness & HR Professionals Financial Educators & Counselors Higher Education Money Habits & Attitudes Blog

Career workshop on money personality and spending habits

Organizations use Money Habitudes in a variety of ways. This is an example of how the money personality tool is used in a career class. The workshop write-up is provided by Amy Mazur, a career counselor at Career Moves, a...

An Improved Series of Financial Classes for TANF

The Issue: How to make TANF financial classes more approachable and effective. Who: Sonya McDaniel, CFLE, is an extension educator who focuses on family and consumer science in Pottawatomie County, Oklahoma. What: McDaniel runs a series of financial classes for...

Financial Educators & Counselors Higher Education Money Habits & Attitudes Blog Therapists, Coaches & Social Workers

financial capability grant: housing, emergency assistance & workforce development

This financial capability grant announcement is applicable to many Money Habitudes users who are doing work in asset building. CFED, in partnership with Bank of America Charitable Foundation, is soliciting applications from organizations interested in joining an eighteen-month Intensive Learning...

Financial Educators & Counselors High School Educators & Youth Leaders Money Habits & Attitudes Blog Therapists, Coaches & Social Workers

Teaching financial management to young kids

Our Money Habitudes materials help people teach financial management to adults and teens. Because the hands-on activity is used like money management games, people often ask if there is a version for young kids. The Money Habitudes for Teens version...

Financial Educators & Counselors High School Educators & Youth Leaders Higher Education Money Habits & Attitudes Blog

Finance in the Classroom

Money Habitudes is now recommended as a resource in Finance in the Classroom. Finance in the Classroom is a service of the Utah State Office of Education and the Utah Education Network. Finance in the Classroom supports Utah's initiative to...

Date-night relationship classes for couples on money

The Issue: How to cover finances in a series of relationship classes – but in a way that's fun enough to feel like a date. Who: Kylee Miller is a project manager at Marriage Matters Jackson, in Jackson, Michigan. The...

Lunch class on financial education

The Issue: How to cover finances in relationship education classes. In addition, how to attract new people and increase attendance in relationship classes. Who: Kylee Miller is a project manager at Marriage Matters Jackson, in Jackson, Michigan. The relationship education...

Teaching personal finance in relationship skills classes

The Issue: Integrate personal finances into a relationship skills curriculum with engaging activities to promote understanding and behavior change. Who: Kara Shade is the Director of Adult Programs at Anthem Strong Families in Dallas, Texas. What: Anthem Strong Families provides...

Financial Educators & Counselors Money Habits & Attitudes Blog Relationship Counselors Therapists, Coaches & Social Workers

Communication skills in relationships

We talk a lot about the right way to talk about money. After all, money is one of the hardest topics for people to talk about. But, what happens when you don't have a good interaction around money? There are...

Case Studies Financial Educators & Counselors High School Educators & Youth Leaders Higher Education

Financial habits, attitudes, behaviors in money classes

The Issue: How to start a series of money classes with an engaging session that covers financial habits, attitudes and behaviors. Who: Jean Dempster and Janet Smith are Asset Development Trainers at Women, Work, and Community in Maine. Both have...

Financial Educators & Counselors Money Habits & Attitudes Blog Relationship Counselors Therapists, Coaches & Social Workers

Bonus financial conversation starters for individuals, couples & counselors

Usually, when people use Money Habitudes as financial conversation starters, they stick to the usual money personality instructions. In the typical solitaire sort, people get to see their money personality for how they are today. But, of course, our financial...

Teaching personal finance to foster care youth

The new "Protecting the Credit of Youth in Foster Care" guide recommends using Money Habitudes. The foster care report was prepared for the Annie E. Casey Foundation by Jennifer Miller and Rebecca Robuck of Childfocus. A good resource for those...

themes in marriage and finances statistics

We track and list marriage and finance statistics because they tell part of the story behind why people use Money Habitudes. After all, what marriage and finances statistics show is that money plays a big role in whether marriages are...

Financial Educators & Counselors Financial Planners Money Habits & Attitudes Blog Relationship Counselors Therapists, Coaches & Social Workers

How to discuss money in a good way

It's important to know how to discuss money. This is true if you are discussing money with a friend, sibling, parent, partner or spouse. It's also important for professionals like financial planners, financial educators and therapists to be able to...

Financial Educators & Counselors Money Habits & Attitudes Blog Relationship Counselors Therapists, Coaches & Social Workers

How to understand your spending behavior

Your spending behavior is how you regularly, almost automatically use your money. Of course, inherent in one's spending behavior are the times when one does not spend, i.e., saving behavior. How does spending behavior develop? We all see and use...

Financial Educators & Counselors High School Educators & Youth Leaders Higher Education Money Habits & Attitudes Blog

Teaching a better money class

If you're a financial educator, how can you teach a better money class? Here are some tips. Tips to teach a better money class No matter if you're working with adults or teens, a money class should be engaging. It...

Financial Educators & Counselors High School Educators & Youth Leaders Higher Education Money Habits & Attitudes Blog Therapists, Coaches & Social Workers

Low literacy financial education materials

About a year ago, we started studying how to produce materials for low-literacy audiences. (The result was our new version of award-winning Money Habitudes for Adults, released in November.) Why? We originally designed the Money Habitudes statements to be quick...

Financial Educators & Counselors High School Educators & Youth Leaders Higher Education Money Habits & Attitudes Blog

Tips: How to write low-literacy financial education materials

A few months ago, we released a new version of our Money Habitudes cards. This version is written with low-literacy financial education audiences in mind. All of the money personality statements were written at a 5th-grade reading level or below....

Tips: money games for adults in financial education classes

Money games for adults make learning about personal finance fun. Using adult games is a different than typical financial education classes. After all, it's not much fun to fill out a budget worksheet. And listening to a financial lecture can...

Overusing the Giving Habitude – charitable money personality type

Money Habitudes cards help people understand their financial habits and general money personality. Money Habitudes are the six most common money types. The activity reveals your money personality and spending habits by showing you your own unique combination of those...

Financial education classes and train-the-trainer for financial educators

The Issue: How to lay a foundation for financial skills by getting students to understand the role of habits, attitudes, emotions and behaviors in their own personal finances. Who: Saundra Davis is the executive director and founder of Sage Financial...

Money Mentors Learn About Financial Behaviors to Relate Better To Clients

The Issue: How to train money mentors to understand how they see money – and how their clients may see money differently. Improve financial coaching. Who: Joanie Davis, Community Initiatives Director at United Way of Henry County and Martinsville. What:...

Credit Union Training on Financial Behaviors, Emotions and Attitudes

The Issue: How to train financial services professionals to easily understand the emotional and behavioral side of finance to better relate to financial clients. Who: Joanie Davis, Community Initiatives Director at United Way of Henry County and Martinsville. What: The...

Financial Educators & Counselors Financial Planners General Info High School Educators & Youth Leaders Money Habits & Attitudes Blog Relationship Counselors Therapists, Coaches & Social Workers

How to talk about money: tips & advice

How to talk about money? Because it's so difficult to talk about money, people often don't talk about it. After all, it's often said that people find it easier to talk about sex rather than talk about money. Tips about...

Corporate Wellness & HR Professionals Faith Based Organizations Financial Educators & Counselors Financial Planners General Info High School Educators & Youth Leaders Higher Education Money Habits & Attitudes Blog Relationship Counselors Therapists, Coaches & Social Workers

Psychology of Money – Money Personality

The psychology of money can be hard to understand. Why do we spend the way we spend? Why do we save? Why might two siblings see the money so differently? What do you think about money? How do you feel...

Financial professionals preferred money profile

Money personality is important, but what is it? In the same way that people have different personalities, we also all have different money personalities. We all see and relate to money in different ways. But how do you know what...

Budgeting and Personal Finance Classes in Relationship Education

The Issue: How to deliver effective budgeting and personal finance classes within healthy relationship education. Who: Deborah Gunn is the program manager for First Things First's federally funded Healthy Marriage Demonstration Grant. First Things First is an award-winning not-for-profit dedicated...

Youth Financial Empowerment Initiative: Financial Literacy for Parents and Kids

The Issue: How to get parents and kids to feel comfortable discussing financial topics in a long-term financial literacy program – and better relate to each other around the difficult topic of money. Who: Tarin L. Washington is a Program Associate...

Transitioning from Financial Literacy Seminars to Financial Counseling

The Issue: How to get more people to feel comfortable attending financial literacy classes – and then to seek out financial counseling. An important component is to help people understand that improving one's finances is often about more than just...

Financial Capability in a Life Skills Program: Foster Kids Transitioning out of Foster Care

The Issue: How to better prepare foster kids transitioning out of the foster care system; this includes financial capability , among other life skills modules. Who: Meghann Shutt, program manager for financial security at Baltimore CASH Campaign. The organization received a...

How to increase attendance in financial literacy programs: 10 ways

Financial education programs can be hard to fill up. Here are some ideas to increase attendance in financial education classes: Frame it differently. Attending financial education programs can be seen as "being in trouble." Because no one wants to be...

Financial Education and Relationship Classes that are Fun and Engaging

The Issue: How to get servicemembers – and their spouses – to want to attend financial education and relationship education classes and come back for more. Who: Gary Strickland, chief of the Airman and Family Readiness Center (AFRC) at Mountain...

Couples counseling meets financial counseling

The Issue: How to get counseling clients to talk about money issues in a constructive, nonjudgmental manner; blending financial counseling and couples counseling. Who: Ben Vos, LPC, is a therapist in Brentwood, TN. He works with individuals, couples and families....

Integrating the Emotional and Behavioral Aspects of Personal Finance into Financial Education

The Issue: How to effectively train financial educators and coaches about the behavioral and emotional side of personal finance so they better understand the concepts and themselves and are thus better able to help their clients and students. Who: Robin...

Making Financial Planning Classes Relevant and Engaging

The Issue: How to get participants in financial planning classes to look at how and why they spend and save. Also, how to talk about money in a fun, non-threatening and engaging way. Who: Robert Cain is an investment advisor...

Financial literacy classes: transitional housing & supportive housing

The goal of supportive housing and transitional housing programs is to provide housing. However, organizations providing housing assistance often also provide financial literacy education. Why? Because people who need housing assistance typically need more than just housing assistance. With an...

Financial literacy classes: FINRA Smart investing@your library

A number of libraries offer financial literacy classes using Money Habitudes through FINRA grants and the Smart investing@your library® initiative. One such institution is the Jackson District Library, Jackson, MI. FINRA grants for financial literacy classes at libraries FINRA is the...

Extension workshop based on Money Habitudes

Billed as a "fun interactive way to talk about the difficult topic of money in a fun, nonjudgmental and constructive way," this is an example of an Extension workshop based on Money Habitudes. A way to engage a new audience...

Identifying Your Client’s Relationship with Money: How It Affects Career & Relationships

This "Relationship with Money" workshop was geared for career and workforce development professionals. In this train-the-trainer case sponsored by Career Counselors Consortium Northeast, it is professionals who are exploring the relationship with money; many other Money Habitudes career classes reach...

Talking about money: a marriage education program in Melbourne, Australia

This marriage education program in Melbourne, Australia uses Money Habitudes cards. Put on by CatholicCare, it highlights the importance that money plays in couples' relationships. Talking about money in a marriage education program This class shares some similarities with other...

WVU Financial EmployeeFest – Employee Benefits Fair

In order to show how organizations really use Money Habitudes cards in employee benefits workshops, here’s an example of a financial seminar for university employees, at West Virginia University. Many Money Habitudes financial education classes are taught by Extension educators....

Habits and Attitudes Affect How You Use Money

In order to show how organizations really use Money Habitudes cards in financial workshops, here's an example of an upcoming financial seminar in Bloomington, Illinois. It's taught by an Extension educator and will be conducted at a bank. For financial...

Financial Literacy Curriculum Wins Financial Education Award

We just won an Excellence in Financial Literacy Education Award (EIFLE) for our financial literacy curriculum. The awards are given by the Institute for Financial Literacy. Awards were presented at the Annual Conference on Financial Education. Money Habitudes Financial Literacy...

Financial Lifestyle Planning Workshop Example

We've been posting some examples of how Money Habitudes users actually use the financial cards in workshops, financial planning seminars, counseling sessions, etc. This is an example of a Financial Lifestyle Planning Workshop in Tampa, FL. The financial planning seminar,...

Financial Education for Supportive Housing and Transitional Housing Programs

The issue: How to build trust with supportive housing and transitional housing clients and help them better understand their spending habits; how to make positive behavior changes. Make financial education classes more engaging and relevant – especially because they aren't...

Financial Life Skills for Teen Parents

The Issue: How to get single teen parents to better understand money messages and financial wants and needs in an engaging atmosphere. Who: Rebecca Phipps, LPC, professional counselor and coordinator of the Between Us program at Catholic Charities Oregon. It...

Spending habits: understanding and changing

When it comes to understanding spending habits, people often forget that they are just that: spending habits. What is a habit? an acquired behavior pattern that is followed regularly so that it is almost involuntary Examples of spending habits Cutting...

A personal finance game in financial education outreach

Like other colleges, Texas Tech understands that it's important to introduce people to personal finance early in their lives. And Texas Tech also understands that it's important to make personal finance fun, approachable and relevant. College Financial Education Week Red...

Money personality assessment results – Money Habitudes

Here's a real money personality type assessment using the Money Habitudes card sorting process: That's me (statements that describe my money personality type) Targeted Goals 9 Selfless 4 Security 2 Status 1 Free Spirit 0 Spontaneous 0 sub-total 16 That's...

Community college financial education for Money Smart Week

Here’s a real example of how a community college is developing a financial education workshop. It's based on using Money Habitudes cards: Harper's Money Smart Week presents: Money Habitudes for Students When:Tuesday, April 24, 2012 2:00 PM - 3:00 PM...

Community college and university personal financial literacy classes

Financial literacy may not be a graduation requirement at a university, college, or community college. However, students must have real financial capability. Why does personal financial literacy matter for university and community college students? According to the 2008 Jump$tart Coalition...

Prisoner reentry programs and financial education

Prisoner reentry programs often include personal financial education within a variety of other life skills classes. This may be in prisons, jails, or community programs. They may include money management in a variety of ways, but the rationale is much...

Community College Money Management Classes: Teaching Personal Finance

Who: Leslie Tomlinson with Student Support Services at Northwest-Shoals Community College in Muscle Shoals, Alabama. What: As part of the college’s Student Support Services grant through the US Department of Education’s TRIO program, the program must offer a variety of...

Money Fight: learning how to talk about money

Couples often find themselves engaged in a money fight. To this end, fighting about money comes up in two recent surveys: Yahoo! Finance Financially Fit Survey from Yahoo! and Fitness Magazine (November 2011) YourTango.com Survey Both reassert what we already...

Talk About Money: 6 Money Languages

There are a variety of personality tests and inventories that are used in marriage and relationship education. A popular one is Gary Chapman’s 5 Love Languages. As the book explains: As people come in all varieties, shapes, and sizes, so...

Financial Education and Relationship Education in Prisons and Inmate Reentry Programs

Who: Ronald Brewer, Director of Education, People of Principle, based in Midland, TX. What: Marriages are subject to a variety of stresses. Instructors typically teach classes to groups of 6-12 couples. It is in this prison environment that People of...

Teaching personal finance using money management games

Money management games help people learn better ways to spend and save. Popular money management games include the Stock Market Game and a variety of offerings developed by Cooperative Extension (such as the Allowance Game). Yet, personal finance is often...

Financial Marriage and Relationship Class: Talking About Money

Having already covered financial education classes and career workshops, this post addresses how Money Habitudes is used in a marriage or relationship class on finances. The example comes from the Portland Relationship Center in Oregon, which conducted a relationship class...

Career workshop and classes on money personality

I just posted that Money Habitudes cards are used all the time in a variety of financial education seminars, job classes, and the like. Well, here’s a good example of a career workshop using Money Habitudes. In this case, JVS...

Community financial education classes using Money Habitudes cards

This is a common example of how community organizations use Money Habitudes cards in their financial education classes. Although we often hear about such financial education classes, many times, they are never posted online, and we're not aware of them....

Money stress, Financial understanding, Talking about money

The American Psychological Association (APA) just released its report: Stress in America: Our Health At Risk. Of course, the number one cause of stress is money. What’s Causing Stress in America? The APA stress report finds sources of stress are:...

Identifying Your Money Personality and Money Type

What is your Money Personality Type There are several money personality types and money psychology personality tests that exist. All speak to the psychology of money, recognizing that our spending and saving often have a habits, attitudes, emotions, and values...

Marriage Counseling, Getting a Divorce: What to do when you fight about money?

Want a divorce? Why couples get divorced? There are a lot of reasons for divorce. However, studies show the most common reason why a husband and wife fight, go to marriage counseling and end a marriage is money. According to...

Catholic Marriage and Money: Finances in Marriage Prep, PreCana

Maybe it’s the economy. Maybe it’s a recognition of the role of money in marriage. We see an increasing number of Catholic archdioceses, dioceses and parishes including instruction on finances in their marriage prep or Pre-Cana classes. It’s not surprising....

Financial Therapy: Credit Profile of Low-Income Families, Financial Empowerment Model

The latest issue of the Financial Therapy Association's Journal of Financial Therapy just came out. The association and journal are concerned with the link between personal financial knowledge, attitudes, behaviors, and personal and family well-being. The assimilation speaks to the: financial...

Cash Tracking and Money Psychology

Just heard about Tweet What You Spend on the radio. While it's not what I thought it was originally, it does address a real issue: cash tracking. (Granted, if you're going to pull out your phone and open Twitter and then...

The Psychology of Personal Finance

Ramit Sethi uses some of Carl Richards's simple economics diagrams to illustrate the psychology of investing and why it's hard to get ahead of the cycle as he looks at Buying High and Selling Low. It's amazing how powerful "napkin sketches" can be when...

Gift Giving: Differing Reasons and Expectations

The holiday shopping season recently passed, and this article in the Vancouver Sun offers some insight into the beast that is gift-giving. We all have different philosophies on giving gifts. Some may not give at all. Some may give lavishly....

Money Habitudes in Catholic School Classes

Where: Immaculate Heart Academy, a Catholic college prep high school in Washington, NJ What: Piloted Money Habitudes cards in psychology and finance classes Who: Stephanie Licata, campus minister Mary Liz Fuhrman, guidance counselor and psychology teacher Students: primarily seniors Why:...

Can money make you happy?

This is a topic that seems to get revisited every year around Black Friday and the holiday shopping season: Can money buy happiness? This recent iteration from The Oklahoman has Bill Sones and Rich Sones writing that: While it's true...

CFSI’s Underbanked Solutions Exchange: Innovation & Consumer Insights

The field of unbanked and underbanked financial services well respects the Center for Financial Services Innovation (CFSI). An interesting quote in advance of the meeting that highlights the role of habits and attitudes about serving underserved financial populations: "During the...

9 Money Questions Before Marriage

In her “Top 9 Money Questions to Ask Your Partner Before You Get Married,” Maria Lin (@marialinnyc) says: “Before marriage, all kinds of lovely conversations ensue: How many kids? What should we name them, Jayden or Hayden or Payden? Where...

Bank On It: Thrifty Couples Are The Happiest

Findings from Bank On It: Thrifty Couples Are The Happiest: Newlywed couples who take on substantial consumer debt become less happy in their marriages over time. By contrast, newlywed couples who paid off any consumer debt they brought into their...

Can’t Buy Me Love: Materialistic Couples Have More Money, Problems

From the Journal of Couple & Relationship Therapy … Scholars at Brigham Young University studied 1,734 married couples across the United States. Each couple completed a relationship evaluation, part of which asked how much they value "having money and lots...

5 Financial Mistakes That Ruin Your Marriage

In this article, Nancy Anderson, a Forbes contributor, identifies the “5 Financial Mistakes That Ruin Your Marriage” as: Materialism – valuing “things” or money over the relationship. Having conflicting money values. Adopting traditional roles when they don’t fit. Having opposing money...

Trending Topics in Psychotherapy: Money, Politics, & Couples

Dr. Nando Pelusi, contributing editor to Psychology Today magazine and a licensed clinical psychologist with a private practice inNew York City, continues with this November series on what's trending in therapy. This week: money, politics, and couples. An interesting discussion about how the economy...

Kahneman TED talk

A TED talk with behavioral economist Daniel Kahneman on “Experience vs. memory” On a related note, this recent story, “Behavioral Economics Foils an Obama Tax Cut?” from Bloomberg BusinessWeek mentions an early experiemtn done by Kahneman and Amos Tversky: They...

Money Attitudes in Basketball

From ESPN.com, Tom Haberstroh's “The predictably irrational NBA lockout” takes a look at how emotions around money come into play in basketball as seen in the NBA lockout… Ariely interpreted this phenomenon as an example of the endowment effect, an imperfection of...

Money Personality Types: Palmer, Koh

We use six Money Habitude types (in a fun and easy-to-use hands-on card game format) to help people better understand how they relate to money and to better comprehend the role it plays in their lives (and the lives of...

Financial Checklist Before Getting Married

Jenna Goudreau (@Jenna_Goudreau) presents a “Financial Checklist Before Getting Married” in Forbes. “Finances have long been a trouble area in marriage,” says Julie Murphy Casserly, author of The Emotion Behind Money, “and the current economic crisis is stretching even more...

Kahneman’s New Way to Think About Thinking

Writing in “The Anti-Gladwell: Kahneman's New Way to Think About Thinking” in The Atlantic, Maria Popova (@brainpicker) calls psychologist (and Nobel laureate and founding father of modern behavioral economics) Daniel Kahneman “one of the most influential thinkers of our time...

Financial literacy programs don’t work?

In a not-subtle article in MarketMatch, Paul B. Farrell, asserts that: Financial-literacy programs are getting popular again. Warning: They don’t work. Maybe for 7% of us. But for the rest of Americans, they are a big waste of your time,...

Women’s Wealth Workshop: Your Psychology and Money

This article about a three-part series about financial issues specifically geared toward women (with a focus on how our beliefs impact our decisions) speaks to several financial planners and therapists who use Money Habitudes to combine psychology and money in...

Thinking like a Woman: An Edge in Trading?

In a recent post on Forbes, contributor Doug Hirschhorn (@DougHirschhorn), who uses sport psychology to coach elite traders on Wall Street, posits that thinking like a woman may give you an edge in trading. Hirschborn says: I believe women, in...

Money: more taboo than sex, religion or political affiliation

This post echoes something therapists and couples frequently hear, as seen in a lecture by Aaron Kipnis, Ph.D., a clinical psychologist in Santa Monica, CA. Money is a subject often more taboo than sex, religion or political affiliation. The myriad...

Unbanked, Underbanked, Pew Report and JoinBankOn.org

Some interesting news as of late in the unbanked and underbanked world: Arjan Schutte (@arjanschutte) of Core Innovation Capital and CFSI estimate: people who don’t rely on banks for their financial needs spend $45 billion in fees and interest, alone....

Money, Marriage and Stress: The View from Ireland

Not really a surprise to see this headline out of Ireland, but interesting to see the global reach of money issues in marriage: Money worries biggest cause of marital distress: Stress: Families feel pressure of rising bills THE majority of...

Kardashian Wedding, Prenups and Talking About Money

After the 72-day marriage ended in divorce, celebrity watchers are speculating about whether Kim Kardashian’s wedding to Kris Humphries, was a made-for-TV hoax. Yet the marriage-and-divorce coverage still highlights an issue common to less grandiose weddings: not knowing your fiancé(e)...

Marriage, Divorce and the Cost of Not Talking About Money

A new article by personal finance expert Erica Sandberg talks about “Six Money Tips For Late-in-Life Divorces.” Tips for exiting an extended marriage include: Employ a lawyer, judiciously. Create a "Now I'm Single" budget. Prepare for merged debt. Plan to...

Gallup-Operation HOPE Financial Literacy Index (GOHFLI)

The initial GOHFLI results demonstrate that the hypothesized link between student success outcomes and financial literacy is a strong one and leaders must work to strengthen all the elements of a student’s success: hope, engagement, wellbeing, and financial literacy. Ten...

High School Tools for Financial Education

A few more thoughts from the third annual Jump$tart National Educator Conference … I sat in on a workshop session about high school financial education tips, which featured a few programs and presenters – and a very full room of...

Jump$tart National Educator Conference

Just back from exhibiting at the third annual Jump$tart National Educator Conference in Washington, DC. The event was attended by a few hundred teachers from all but six of the United States (Alaska and Hawaii one can understand, but Georgia...

Common Money Mistakes Parents Make: Talk to Your Kids

A good recent article (in which Syble is quoted) this month in Delaware Moms magazine says that: The most common mistake parents make with money and their kids is not communicating honestly about finances. This can run the gamut from...

Money Habits and Attitudes

Money is not a topic we like talking about. Many people say they find it easier to discuss sex. It covers behavioral finance, economics, the psychology of money, microfinance, and various approaches to address money in different professions and contexts...

Talking About Money in Continuing Education Workshops

Who: Kelly Chicas, a Board Certified, Licensed Professional Clinical Counselor (at Albuquerque Family Counseling), and Lisa Johnson, PhD, LMFT in Albuquerque, New Mexico Situation: Workshops for community agencies and general audiences to provide educational information and introduce therapists in a...

Teaching Financial Literacy Classes to Teens and Senior Citizens

Teaching financial literacy classes can be difficult. Talking about money intimates people and they often wait until hardship strikes before seeking help. Therefore, financial educator Nancy Reigelsperger knows she needs to make her financial literacy classes not only practical, but...

Money Habitudes Storms the Dorms for Financial Readiness

Contact: Erica Brown, a community readiness technician at Shaw Air Force Base Airman and Family Readiness Center (AFRC) Situation: A financial education class to reach young airmen on their turf, in the dorms. The workshops in the barracks would eliminate...

Preparing the Navy’s Peer Financial Counselors

Contact: Carol Allison, Financial Program Manager, Naval Support Facility (NSF) Dahlgren/The Navy's Command Financial Specialist (CFS) program Situation: Use Money Habitudes cards in preparing Navy Command Financial Specialist Counselors to be financial first responders to their colleagues Who: Command Financial...

Money Habitudes Helps Save Marriages from Divorce

Contact: Kent Thompson, Financial Program Manager with Army Community Service, Camp Ederle, U.S. Army Garrison, Vicenza, Italy Situation: A comprehensive, six-hour course for couples intending to divorce called Military + Divorce was created by the Association of Financial Counseling, Planning,...

Financial Education to Make the Military "Mission Ready"

Contact: Madeleine Greene, Personal Financial Counselor, Contractor for the Department of Defense. Greene worked as a financial counselor and educator for Cooperative Extension Service through the University of Maryland for more than 15 years. Situation: Financial education workshops on military...

Teaching Couples Skills to Communicate About Finances

Financial education classes often neglect communication skills and focus solely on the mechanics of budgeting, expense tracking, etc. But Lori Scharmer, a family economics educator, finds great value in helping couples communicate about money. If they aren't comfortable talking about...

Money Habitudes Breaks the Ice, Beats Pizza and Boosts Attendance

Contact: Kent Thompson, Army Financial Program Manager, Army Community Service (ACS), Camp Ederle in Vicenza, Italy Situation: Financial education classes without funding attract soldiers to a class by offering pizza or other food. Who: Soldiers, whether generally unwilling and uninterested...

Using Money Habitudes in Bankruptcy Classes

Contact: Beverly Mercer, court-appointed bankruptcy trustee, Waco, Texas Situation: The State of Texas mandates that any Texan who files for bankruptcy must attend a bankruptcy class that teaches them how to avoid bankruptcy in the future. Mercer teaches 3-5 classes...

Talking about Money in Catholic Marriage Preparation Classes

Contacts: Valerie Conzett, director of the Family Life Office in the Archdiocese of Omaha, and Sr. Virginia West, a marriage and family therapist at St. Margaret Mary Catholic Church in Winter Park, FL. Situation: Catholic churches and dioceses use Money...

Better Understanding Financial Planning Clients

Contact: Tony Owings, Certified Financial Planner, A.R. Owings Financial Strategies, an independent firm that works mostly on a fee-on-assets-under-management and offers securities through Raymond James Financial Services Situation: Financial planners need to understand their clients, including how they see and...

Better Understanding Yourself And Your Clients Regarding Money

Contact: Alan Frank is a financial educator and planner, serving as Financial Services Lead Instructor at Bow Valley College in Calgary, Canada Situation: He teaches college students who are studying to become financial planners and clients who attend the classes...

A Life Skills Class for Teens that Nearly Runs Itself

Teenagers like to interact with each other rather than sit still for lectures. Playing to this tendency, Joyce Bartels-Daal uses Money Habitudes as the basis for a money-based life skills class. Students enthusiastically dive into the activity and need little...

Tackling Financial Literacy for Teens, Homebuyers and Seniors

Instead of sleep-inducing PowerPoint slides and a lecture, Belinda Pfeiffer, a family and consumer sciences educator, uses Money Habitudes for Teens to connect with teenagers in schools and youth groups. When using Money Habitudes with homebuyer/homeowner classes and with senior...

Spouses Group Meets for Coffee and Money Habitudes

One of the great friction points in marriages is money. Although people do not want to talk about it, they do want to be able to deal with it effectively. To help people introduce the difficult topic, talk about it,...

Talking About Money Builds Healthy Relationships

In working to build and sustain healthy relationships, Stronger Families knows that money plays a crucial role. Therefore, the organization includes a module on money and communication – using Money Habitudes cards – in its hallmark relationship program, which largely...

A New Approach to Money in Counseling Sessions

Contact: Kelly Chicas, a Board Certified, Licensed Professional Clinical Counselor, Albuquerque Family Counseling, Albuquerque, New Mexico Situation: Private counseling sessions Who: Individual clients and couples seeking relationship counseling. What: Use Money Habitudes cards as a tool to draw clients into...

A Life Planning Approach to Financial Planning

Contact: Steven Shagrin, CFP, has a law degree and started his career in finance as a tax accountant before spending twenty years as vice president for investments with Smith-Barney and Pain Webber. As one of the pioneers of the life...